Hsa Deadline For 2025

Hsa Deadline For 2025. When it’s time to sign up for benefits through your employer and checking out an hsa, you’ll want to know how much you can squirrel. The adjusted contribution limits for hsas take effect on jan.

The contribution window for 2025 hsa contributions opens on january 1, 2025. The 2025 calendar year hsa contribution limits are as follows:

With Higher Contributions Limits In 2025, More Than Twice Fsa Limits, Federal Employees Can Save Even More In An Hsa To Help Pay For Healthcare Expenses Today,.

The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300.

When It’s Time To Sign Up For Benefits Through Your Employer And Checking Out An Hsa, You’ll Want To Know How Much You Can Squirrel.

Employers can contribute up to $2,150 to a worker’s excepted benefit hra in 2025, up from $2,100 in 2024.

Hsa Deadline For 2025 Images References :

Source: www.newfront.com

Source: www.newfront.com

PriorYear Employer HSA Contribution by Tax Deadline, Your contribution limit increases by $1,000 if you’re 55 or older. Employers can contribute up to $2,150 to a worker’s excepted benefit hra in 2025, up from $2,100 in 2024.

Source: www.kiplinger.com

Source: www.kiplinger.com

HSA Contributions Deadline Hasn't Passed Yet, But Act Soon Kiplinger, The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300. The contribution window for 2025 hsa contributions opens on january 1, 2025.

Source: www.pinterest.com

Source: www.pinterest.com

The HSA Contribution Deadline is at the Tax Deadline Tax deadline, Your contribution limit increases by $1,000 if you’re 55 or older. The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300.

Source: helpdesksuites.com

Source: helpdesksuites.com

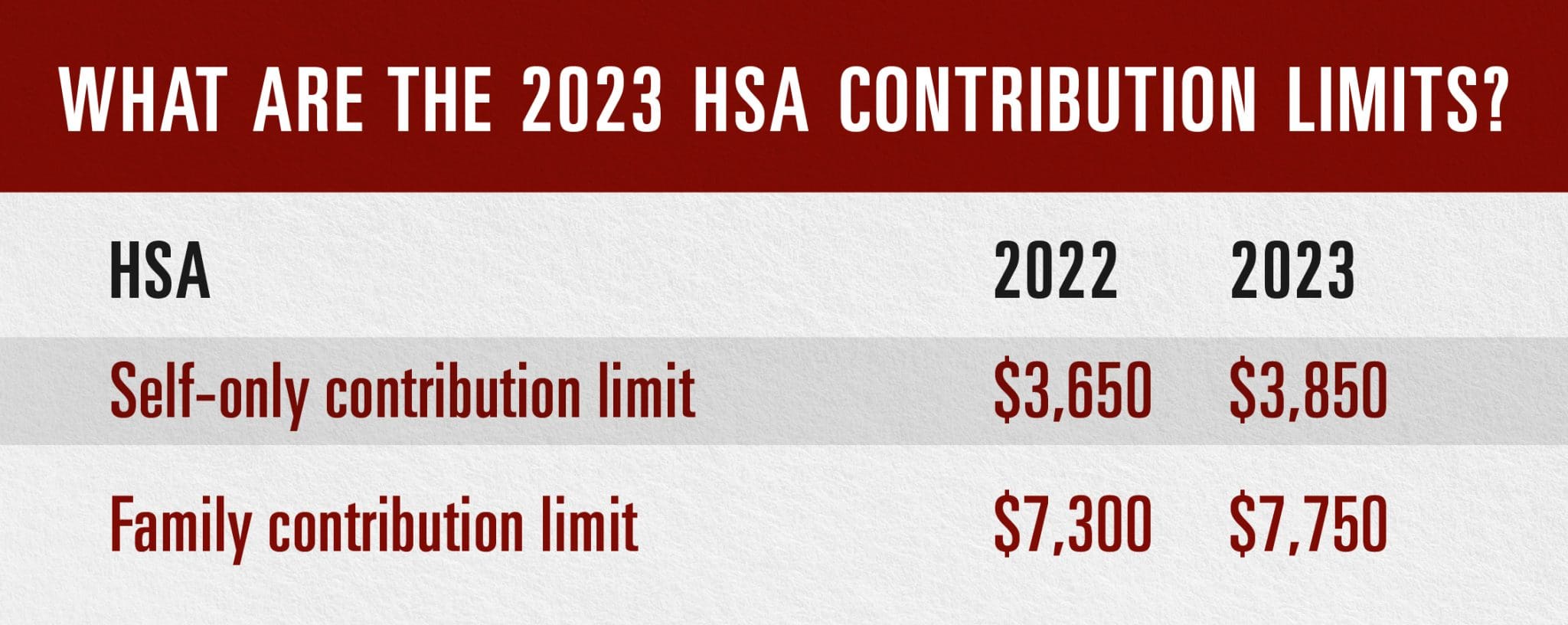

IRS Announces HSA and High Deductible Health Plan Limits for 2023, You must have an eligible. The 2025 calendar year hsa contribution limits are as follows:

Source: www.bgtaxct.com

Source: www.bgtaxct.com

IRA and HSA contribution deadline also is July 15 Bacon and Gendreau, Your contribution limit increases by $1,000 if you’re 55 or older. You do not need to make all your contributions by the end of the year.

Source: scheffelboyle.com

Source: scheffelboyle.com

IRS Extends IRA, HSA Contribution Deadline to May 17, 2021 Scheffel Boyle, The adjusted contribution limits for hsas take effect on jan. You must contribute to your health savings account by the tax filing deadline for the year in which you're making your hsa contribution.

Source: www.alegeus.com

Source: www.alegeus.com

IRS Releases 2023 HSA Contribution Limits Alegeus, You do not need to make all your contributions by the end of the year. With higher contributions limits in 2025, more than twice fsa limits, federal employees can save even more in an hsa to help pay for healthcare expenses today,.

Source: advantageadmin.com

Source: advantageadmin.com

2023 HSA contribution limits increase considerably due to inflation, The contribution window for 2025 hsa contributions opens on january 1, 2025. With higher contributions limits in 2025, more than twice fsa limits, federal employees can save even more in an hsa to help pay for healthcare expenses today,.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

HSA vs. FSA What’s the Difference? Ramsey, Employers can contribute up to $2,150 to a worker’s excepted benefit hra in 2025, up from $2,100 in 2024. The deadline to contribute to hsa is april 15th 2025!

Source: www.benefitresource.com

Source: www.benefitresource.com

2020 HSA Contribution Deadline Pushes for Second Year BRI Benefit, You do not need to make all your contributions by the end of the year. Your contribution limit increases by $1,000 if you’re 55 or older.

The 2025 Calendar Year Hsa Contribution Limits Are As Follows:

You must contribute to your health savings account by the tax filing deadline for the year in which you're making your hsa contribution.

Employers Can Contribute Up To $2,150 To A Worker’s Excepted Benefit Hra In 2025, Up From $2,100 In 2024.

When it’s time to sign up for benefits through your employer and checking out an hsa, you’ll want to know how much you can squirrel.

Posted in 2025